So sending someone $100 will actually cost you $103. There is no fee to set up your account.

A Sneak Peek Into The Unreleased CASHCARD By Square Cash

Some fees, like atm charges, will be reimbursed up to 3 times per month and up to $7 per withdrawal if you receive at least $300 in direct deposits to your cash app account each month.

Cash app direct deposit atm fee. Once you have received qualifying direct deposits totaling $300 (or more), cash app will reimburse fees for 3 atm withdrawals per 31 days, and up to $7 in fees per withdrawal. Loyal customers can earn boosts that take them over $250 too! Cash app allows you free atm money withdrawals.

Retail service fee and limits apply. Earn up to 7% instant cash back when you buy egift cards in the app 1. Withdrawals are limited to a total of $500 per day.

Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements. Even though lincoln savings bank manages cash app accounts, sutton bank still plays a vital role in cash app operations. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month.

If you want to set up direct deposits to your cash app via the cash card, you will need the sutton bank cash app routing number. Please refer to your card fee schedule. The app belongs to square inc.

38 rows all fees amount details; Cash support atm fees on cash card most atms will charge an additional fee for using a card that belongs to a different bank. Cash app users who use their cash app cash card to withdraw at any given atm are charged a fee of $2.

Set up a vault and earn over 10x the national savings rate average. There are instances where cash app reimburses cash app users when they withdraw at atms using their cash card. There is a maximum atm / cash back withdraw limit of $400 / day total from the branch card.

Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. If youre still on the fence, compare these two apps by fees, speeds and many more options using our breakdown table to figure out which service is best for you. Accepting direct deposit and managing your money in a digital wallet.

Cash app has a payment card by the name cash card from sutton bank. Find your nearest cash deposit location in the go2bank app or visit a retail location near you. All other atms may apply an owners surcharge fee in addition to the atm cash withdrawal fee disclosed in your deposit account agreement.

If you are sending money via a credit card linked to your cash app , a 3% fee will be added to the total. Stocks, cryptocurrencies, digital wallet services, transfers and more. The app unlocks the ultimate in value.

Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. To access your cash app account number, follow these steps: A standard $10,000 cash deposit (notes and coins) limit applied per account per day.

You must pass an additional validation process. With a direct deposit option activated on your account, you can freely withdraw money through an atm. Green dot network cash reload fees and limits apply.

Scroll down and select direct deposit . Cheques deposits require the standard clearance days. You can get free atm withdrawals if you deposit at least $300 per month into your cash app account.

Cash app users who receive qualifying direct deposits that total up to $300 plus get reimbursed for every 3 atm withdrawals per 31 days or a full month. Tap get account number . With direct deposit, youll gain access to the highest amounts of instacash.

Cardless cash is available from any commbank atm. However, sending money with a linked debit card or bank account is free with cash app. Deposit up to 200 notes and 50 cheques without an envelope.

Cash app cards let you withdraw money from any atm for a $2 fee. Or, you can deposit cash using your go2bank debit card at a retail store. Diverse options in one app:

You have to pay $2 on every amount withdrawn at the atm using a cash card with a direct deposit. The account doesnt earn interest, you cant deposit or write checks, and theres a $2 atm fee. Atms may also charge additional fees on top of this in the form of a flat rate or percentage.

This is a rather standard fee with. $2 fee for cashapp, but all fees can be waived with direct deposits of. Deposit up to 2kg of coins at selected machines.

But you can deposit cash using the app at a retail store. If you make a minimum deposit of $300 in your cash app account, cash app will refund up to $7 for three atm fees every 31 days. There is a maximum atm / cash back withdraw limit of $3,000.00 / month total from the branch card.

With 1% apy on savings quarterly up to $5,0003. Viewing + changing your atm / cash back limit preferences. No, it is not possible to deposit cash to a go2bank account using an atm.

Get Fast Cash in Just 15 Min with No Credit Checks Hassle

How To Choose The Best Prepaid Debit Card in 2020 Saving

Pin di Cara Daftar dan Buat Binance Card

Pin by Erica Whitlock on bali Visa debit card, App, Cash

Dribbble wellsfargo03.png by Andrew Dotson in 2020

8 Lessons Ive Learned From Wells Fargo Balance Transfer

Giving a 6YearOld a Debit Card Sounds Insane. Here's Why

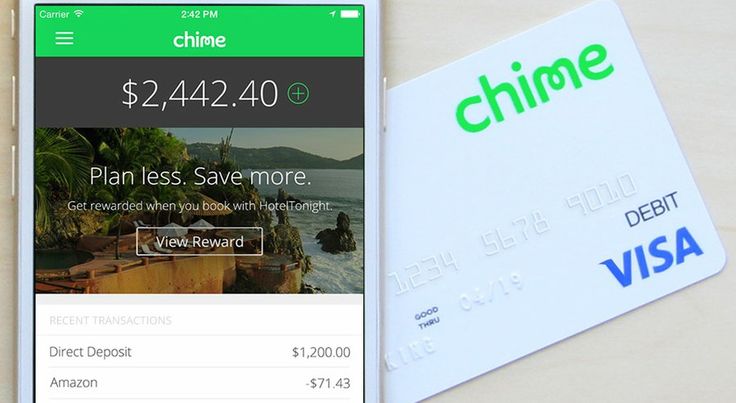

A mobile banking service designed with millennials in mind

RushCard Apply Now Prepaid Visa Debit Card Application

Bank Statement in 2020 Banking app, Visa debit card

Free Money? 4 Apps to Make Earning Cash Back Simple Drop

Direct Lender Guaranteed Payday Loans No Matter What in

Cash App Support +1 (888) 8602448 App support, App, Cash

Chime Banking Banking services, Visa debit card, Banking app

Cash App Wont Accept My Debit Card TAX TWERK Debit